Today is May 29th, aka 529 day. In honor of today, here are 29 things you need to know regarding 529 plans and how they can help your business, your employees, and their dependents.

1. Definition of 529 Plans

Per the Securities and Exchange Commission (SEC), a 529 plan is a tax-advantaged savings plan to encourage saving for future education costs. These plans, also known as “qualified tuition plans,” are authorized by Section 529 of the Internal Revenue Code.

2. There’s a Need for 529 Plans (College is Expensive!)

According to the College Board, the average cost of college in the U.S. for the 2019-2020 school year rose 3.4 percent over the previous year. Now, the average U.S. student spends $36,880 per year. And these costs are only expected to continue to grow.

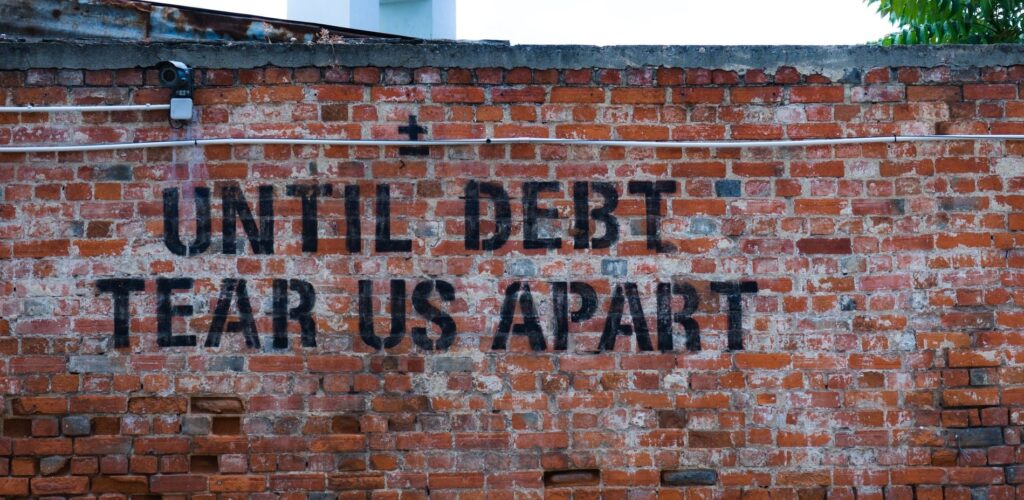

3. Seriously, a 529 Plan Can Help

Because of the exorbitant cost to attending college, a 529 plan can be invaluable in helping you or your child(ren) avoid excessive school loans. In 2018, the average American college graduate entered the workforce with $40,000 in student loans.

4. Most Kids Don’t Have One

According to MarketWatch, only 1 in 5 children under age 18 has a 529 plan. So, starting a 529 plan for your child can be a significant advantage for them.

5. Those Who Do, Don’t Have Enough Saved

Like retirement plans, just starting a 529 plan isn’t enough. The average 529 balance, per MarketWatch, is $25,000. While this may seem significant, it’s barely enough to cover even a year at a private or out-of-state school.

6. Contributing Early on is Essential

It’s easy to put off until tomorrow, especially the younger you are. Still, any parent should begin saving in their 529 as soon as possible. That’s because, no matter your current financial statement, the cost of college is only going to rise. Per CNBC, the average tuition increase is 3 percent a year.

7. Time is Your Greatest Asset

The quicker you begin saving, the quicker you will earn interest. Subsequently, you will more quickly start to earn compounding interest – which is interest on your interest. This compounding interest is the backbone for any financial savings tool.

8. There are Two Types of 529 Plans

There are two primary types of 529 plans: prepaid tuition plans and education savings plans.

9. Prepaid Tuition Plans

Prepaid tuition plans let a saver/account holder purchase units or credits at a participating college/university. The saver or account holder gets to lock in tuition and mandatory fee costs at current prices for the beneficiary. Typically, prepaid plans cannot be used to pay for future room and board at a college or university. They also don’t allow you to prepay for tuition for elementary or secondary schools.

10. Education Savings Plan

Education savings plans let a saver open an investment account to save for the beneficiary’s future qualified higher education expenses. These qualified expenses include tuition, mandatory fees, and room & board. You can usually use these plans to pay for any college or university. Education savings plans can also be used to pay up to $10,000 per year per beneficiary at any public, private, or religious elementary or secondary school.

11. States Sponsor Many 529 Plans

All 50 states, and D.C., sponsor at least one type of 529 plan. But pay attention to your state’s specific plan, because each state has unique state policies.

12. State-Specific Contribution Limits

Just like each state has its own 529 plan, each state’s 529 plan has a specific total contribution limit. These limits are generally between $235,000 and $520,000 per US News.

13. Know Your State’s Unique State Policies

As mentioned above, almost every state has slightly different rules for its state-sponsored 529 plans. In addition to specific contribution maximums, every state also allows you a once-per-year rollover to another 529 plan with no tax consequences.

14. Most States Offer Residents Deductions

More than 30 states currently offer 529 plan deductions for in-state residents who contribute to such a plan. Still, there are a few states that don’t provide this deduction, including: CA, DE, HI, KY, ME, NJ, NC, AK, FL, NH, NV, SD, and TX.

15. How Will a 529 Plan Affect Your Taxes?

Investing in a 529 plan may provide you with special tax benefits. These benefits vary depending on your state and the 529 plan. Plus, this information is always subject to change. So, make sure you understand the tax implications of investing in a 529 plan before you choose a plan.

- Effects of 529 Contributions: Many states offer tax benefits for contributions to a 529 plan. These benefits may include deducting contributions for state income tax, or matching grants. But these deductions may have various restrictions or requirements. Additionally, you may only be eligible for these benefits if you invest in a state-sponsored 529 plan.

- Effects of 529 Withdrawals: If you use 529 withdrawals for qualified expenses, earnings in your 529 account aren’t subject to federal income tax, and often, state income tax. Note, there is a tax penalty if you make a non-qualified withdrawal.

16. How Will it Affect Financial Aid?

Each financial institution may treat assets held in a 529 plan differently. And some institutions may reduce the amount of aid they offer you or your child because of your 529 investments. Still, per CNBC, saving always helps more than it hurts.

Plus, your financial aid is affected to a minimal extent by your 529 plan. While formula for financial assistance is complicated, many families can use the following example as a template.

Example: Many families are expected to contribute about 20 – 30 percent of their income to college each year. And parents are only expected to contribute 6 percent or less of their parental savings, including 529 plans.

So, for every $10,000 you save, you’ll lose out on $600 of financial aid. That $10,000 helps you out a lot more than the $600 lost in financial aid.

17. Changes to 529 Plans via the SECURE Act (Change #1)

Until the SECURE Act was signed into law in December 2019, opening a 529 plan meant assuming your college would go to a 2- or 4-year college or university. Now, through the SECURE Act, any type of higher education expenses are qualified expenses with no penalty. These places of higher education include technical schools, trade school programs, and apprenticeship costs.

Read more about how the SECURE Act affects retirement plans here.

18. Changes to 529 Plans vis the SECURE Act (Change #2)

The other significant change to 529 plans, via the SECURE Act, is the ability to use 529 funds to repay college student loan debt. Account owners may now withdraw up to $10,000 tax-free for payments toward qualified education loans. Note that any student loan interest paid for with tax-free 529 savings plan earnings isn’t eligible for a student loan interest deduction.

19. What’s a Qualified Withdrawal

For college savings plans, eligible institutions include:

- Most accredited colleges and graduate school

- Professional and trade school

- Foreign schools with attending students who receive financial aid

Contributions also apply to a variety of qualified educational expenses, including tuition, books, and room & board. Parents can also withdraw up to $10,000 per student per year to spend on tuition for private K-12 education. Note, these K-12 withdrawals cannot be used on any additional expenses or activities.

20. Penalties of Non-Qualified Withdrawals

If you use contributions for unauthorized purchases, your state or the federal government will recapture those tax deductions. Plus, you’ll have to pay a 10 percent penalty on any of your investment’s gains.

21. You Can Use it on Yourself

Yes, any saver may set up a 529 plan in their own name to fund their personal education. Plus, any money left over in your 529, you can transfer to the 529 of a child or grandchildren.

22. Don’t Hoard Your Balance

If you save well, you may get the idea to save some of your 529’s balance to pay for your child’s or grandchild’s future professional or graduate school. But, MarketWatch, warns against this idea. If you have the money, it’s generally smarter to help your child graduate from undergraduate school with no debt. Rather than worrying about paying for any potential future schooling.

23. Choose Your Plan Carefully

It’s imperative for anyone looking to invest in a 529 plan to choose which plan you use carefully. As stated below, any potential 529 investor needs to examine the plan’s fees, expenses, investment choices, and restrictions before they choose to invest. Don’t choose based on one factor, such as a tax deduction. Keep in mind all facets of the plans you’re considering before you make a choice.

24. Understand Your Plan’s Fees and Expenses

Every 529 plan carries various and differing fees and expenses. There are advisor fees, program management and maintenance charges, and underlying investment fees. These fees and costs can vary significantly from plan-to-plan. Generally, actively managed funds will have higher underlying expenses than index funds.

25. Know Your Plan’s Investment Choices

Typically, you invest money contributed to a 529 plan in mutual funds or exchange-traded funds managed by financial companies. Each plan option offers a different mix of funds, which allows you to pick which mix best suits your current situation. Investors can choose between either age-based or static options. Each of these options carries unique advantages and disadvantages. Contact your financial advisor to determine which option best suits you.

26. Restrictions on Investments

Before choosing a 529 plan, read the plan’s details to make sure you understand, and are comfortable with, any plan restrictions. Education savings plans have specific pre-set investment options. It isn’t permitted to switch freely among options, per the SEC. Under current law, an account holder is only permitted to change his/her investment option twice per year. Or when there’s a change in the beneficiary.

27. Pluses to 529 Plans

According to BlackRock, 529s have three primary benefits for account holders. Those benefits are:

- The ability to save, tax-free, for educational expenses

- Tax-free withdrawals when used for eligible expenses

- Low minimum contribution

28. Greatest Advantages 529’s Provide

The most significant advantage of a 529 plan versus traditional investments is the tax implications. As previously stated, you can make qualified 529 withdrawals tax-free. If you withdraw from conventional investments, any amount earned from that fund is taxed. Plus, your 529 investments grow tax-free.

29. Your Most Important 529 Plan Resource

One of the most critical resources to help you implement a 529 plan either for yourself, or your business, is a trained financial advisor. The Olson Group has three dedicated and trained financial/retirement professionals available to help you.

So, contact one of our trusted advisors today!