It’s impossible to overstate the importance of financial wellness in the workplace. This benefit works to protect your employees financially, and otherwise. Finances and the stress they cause can have a substantial impact on your organization’s success.

According to a 2017 survey from Mercer, employers can lose up to $250 billion a year due to employees’ stress about their finances, alone. This survey found there is a real risk when workers spend time worrying about their finances. At any given time, approximately five percent of an organization’s total payroll is at risk.

If you let it, financial stress can dominate your workforce, and therefore your company’s bottom line. Luckily there are ways to battle back against financial stress. One of the best methods is to implement a financial wellness program.

These programs help to improve your staff’s financial education and create a long-term plan to reach future financial goals. Educating and planning for the future work together to lessen individual’s financial stress.

Financial Wellness in the Workplace

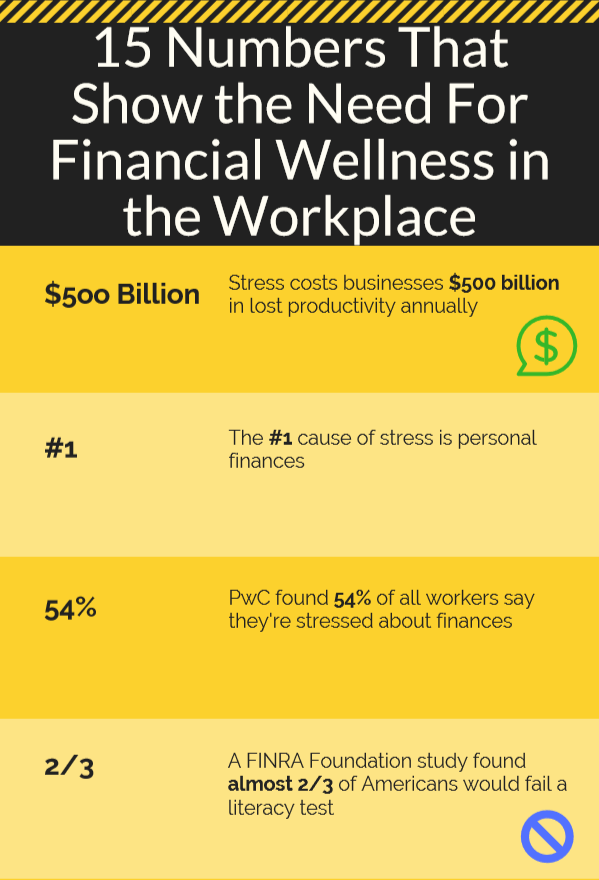

1. $500 Billion

Stress costs U.S. businesses a total of $500 billion a year in lost productivity, according to Mental Health America. This statistic demonstrates the immense adverse impact stress can have on your business.

2. #1 Cause

Finances, according to several studies, is the top cause of stress for American employees, young people, and couples. Again, each of these studies shows the powerful influence finances have on essentially everyone.

3. 54 Percent of Workers

According to PricewaterhouseCoopers, 54 percent of workers say they’re stressed out about finances. So, it’s likely in your company now, more than half of your employees are facing stress due to money.

4. 2/3 of Americans

A FINRA Foundation study found 2/3 of Americans would fail a financial literacy test. Without the proper financial education, your workers will struggle with even the most simple financial principles. Basic financial education has to be a part of your financial wellness program to combat the effects of financial stress.

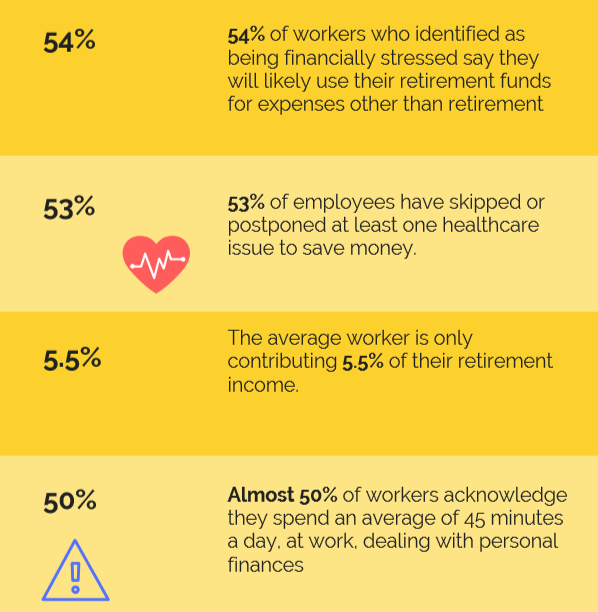

5. 54 Percent of Employees

Per, PricewaterhouseCoopers, 54 percent of employees who identify as being financially stressed say they’ll likely use their retirement funds for expenses other than retirement. Those who are financially stressed are more likely to make financial mistakes.

A financial misstep, like early withdrawal from a retirement account, can be serious for individuals. And these financial missteps only grow in gravity with the age of the said individual. Financial wellness can help these individuals avoid such egregious financial.

6. 53 Percent of Workers

According to BenefitsPro, 53 percent of employees have skipped or postponed at least one healthcare issue, to save money. It’s important to remember a significant part of financial wellness is dependent on health.

Medical treatment and health insurance are costly, and good health can save you from the potentially astronomical cost of care in the U.S. Make sure your employees are educated healthcare consumers and they can save thousands of dollars over the course of even one year.

7. 5.5 Percent

The average worker, according to BenefitsPro, is only contributing 5.5 percent of their income into retirement. This figure is almost ten percent less than the typically recommended average of 15 percent. The fewer employees save for retirement, the longer they’ll have to work.

![]()

8. 50 Percent of Employees

Again, per BenefitsPro, almost 50 percent of workers acknowledge they spend time at work dealing with finances. In fact, these people spend an average of 45 minutes per day, or three hours a week, dealing with personal finances at work.

9. 78 Percent of Americans

Seventy-eight percent of Americans said they live paycheck to paycheck, according to a report from CareerBuilder. Those living paycheck to paycheck are more likely to be in debt and not saving for retirement or emergencies.

![]()

Lacking these savings increases the likelihood of your employees’ suffering financial stress. Most financial experts, for example, recommend having, at least, a six-month emergency fund. If a majority of your staff is living paycheck to paycheck they likely have nowhere near this amount of money saved.

10. 64 Percent of Workers

Over half, 64 percent, or workers in the U.S. can’t cover a $1,000 emergency without borrowing money. Similar to the previous number, this statistic demonstrates the inability of the average American to save money. Financial education services can give employees the knowledge and confidence necessary to avoid unnecessarily borrowing money.

11. 24 Percent of Take-Home Pay

The average U.S. employee spends 24 percent of their take-home pay on consumer debt payments. Similarly, last year, according to the Federal Reserve, the average American household carries $137,063 in debt. Both of these numbers demonstrate the amount debt influences American workers.

12. 50 Percent Reduction

In 2017, the Center for Retirement Research at Boston College found interesting results linking the gender savings gap and financial wellness and education. Their study found these services can reduce the gender savings gap by over 50 percent.

This research showed financial literacy and implementing long-term financial education plans increased participation by women in retirement plans. Closing the gender savings gap is imperative for any firm wishing to achieve total employee financial wellness.

![]()

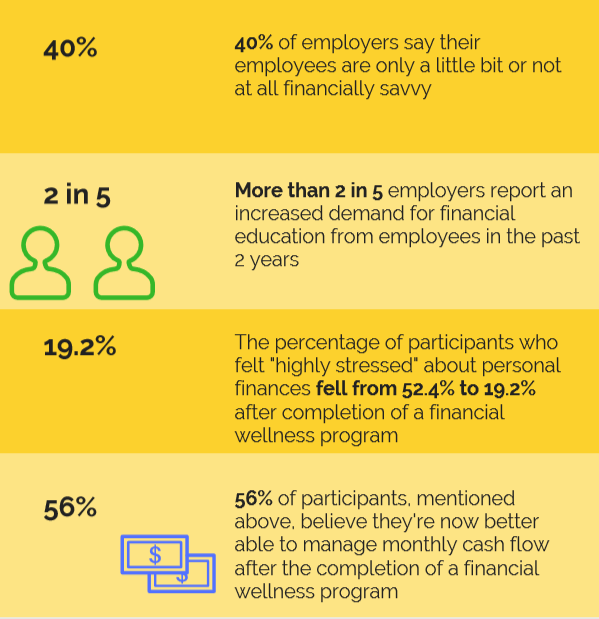

13. 40 Percent of Employers

According to research from the International Foundation of Employee Benefit Plans, almost half of U.S workers struggle with navigating their finances. This research found 40 percent of employers say their employees are only a little or not at all financially savvy.

14. 2 in 5 Employers

More than two in five employers report an increased demand for financial education from employees in the past 2 years. Employees are signaling they desire financial wellness and education more and more.

15. 19.2 and 56 Percent of Participants

According to Employee Benefit News, participants in financial wellness programs demonstrate real improvement in their financial knowledge. The percentage of participants felt “highly stressed” about personal finances fell from 52.4 percent to 19.2 percent after completion of a financial wellness program.

Similarly, 56 percent of these participants also said they believe they’re better able to manage monthly cash flow better after the completion of a financial wellness program.

The Wrap

Financial stress has a tangible, and sizable, impact on your firm’s bottom line. The above 15 statistics show the true influence of financial stress on your employees. Similarly, the demonstrate how a financial wellness program in the workplace can reverse these negative effects. Implement a financial wellness program and get your employees’ finances healthy.